Streamline Compliance Assessment

Streamline your audit process by significantly cutting down on redundant evidence requests.

Read more

Assessment

Secured on all sides

Coalfire Compliance Essentials platform coordinates assessments across frameworks, reducing manual effort by 40%.

Secured on all sides

Cost-effective security assessments that reduce risk, address vulnerabilities, and align with regulations.

Secured on all sides

Speed is critical in the AI race. But so is security. Get certified for your Artificial Intelligence Management System (AIMS).

We tackle the world’s toughest, most complicated compliance challenges. Analyzing, automating and streamlining them through our mastery of expedited compliance protocols. With expertise across PCI DSS, HITRUST, ISO, FedRAMP and 100+ frameworks, we assess, simplify and provide guidance through rigorous attestations and certifications. All, to empower you with the support and tools needed to meet objectives, simplify and synchronize processes and confirm system readiness.

Independent SOC 1, SOC 2, and SOC 3 reports that satisfy regulator, auditor, and customer trust requirements.

15+ years as a PCI Qualified Security Assessor, guiding organizations through PCI DSS assessments and remediation.

Accredited FedRAMP 3PAO with deep experience in DoD IL4–IL6 and civilian agency authorizations.

HITRUST CSF and HIPAA assessments tailored to healthcare security and privacy requirements.

Audits and/or readiness assessments against core ISO standards (27001, 27701, 42001, 9001, etc.), aligned with international best practices.

Support across 100+ and other emerging international requirements related to information security & privacy—4x more than our competitors.

Expert-led PCI + FedRAMP compliance assessments with penetration testing to validate controls and certifications.

Meet multiple compliance objectives with a single assessment. Our synchronized approach reduces audit fatigue, saves budget, and provides a clearer view of your security posture.

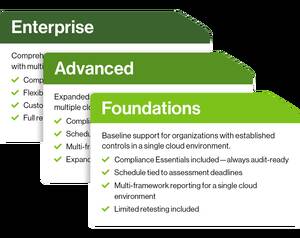

Tailored to organizational maturity, risk profile, and budget, delivered through Coalfire’s coordinated methodology to reduce audit fatigue and map results across frameworks.

For organizations with established compliance programs that need expert support and ready-to-use tools to stay audit-ready.

✔️ Compliance Essentials included—always audit-ready

✔️ Schedule tied to assessment deadlines

✔️ Multi-framework reporting for a single cloud environment

✔️ Limited retesting included

For organizations optimizing their compliance programs for cost, performance, and scalability. Combines out-of-the-box and custom tools for greater efficiency.

✔️ Compliance Essentials included—always audit-ready

✔️ Schedule tied to assessment deadlines with limited flexibility

✔️ Multi-framework reporting for multiple cloud environments

✔️ Expanded retesting options

For global enterprises with complex multi-cloud, multi-region portfolios. Provides comprehensive support to manage custom controls and diverse regulatory needs.

✔️ Compliance Essentials included—always audit-ready

✔️ Flexible scheduling tied to assessment deadlines

✔️ Customized Coordinated Assessments across geographies and frameworks

✔️ Full retesting options

As the leader in compliance capabilities, we’ll help you strengthen security, simplify compliance, and scale with confidence.

Coalfire’s automation platform centralizes compliance work and reduces manual effort, bringing 100+ frameworks together in one place.

Streamline Compliance Assessment

Read more

Full Compliance Journey

Read more

Intelligent Automation

Read more

Continuous Compliance

Read more